Forms 1120-S, 1065, and 1042 are due by March 17, 2025. Request an Extension Now

IRS FORM 7004 - An Overview of Business Tax Extension

Form 7004

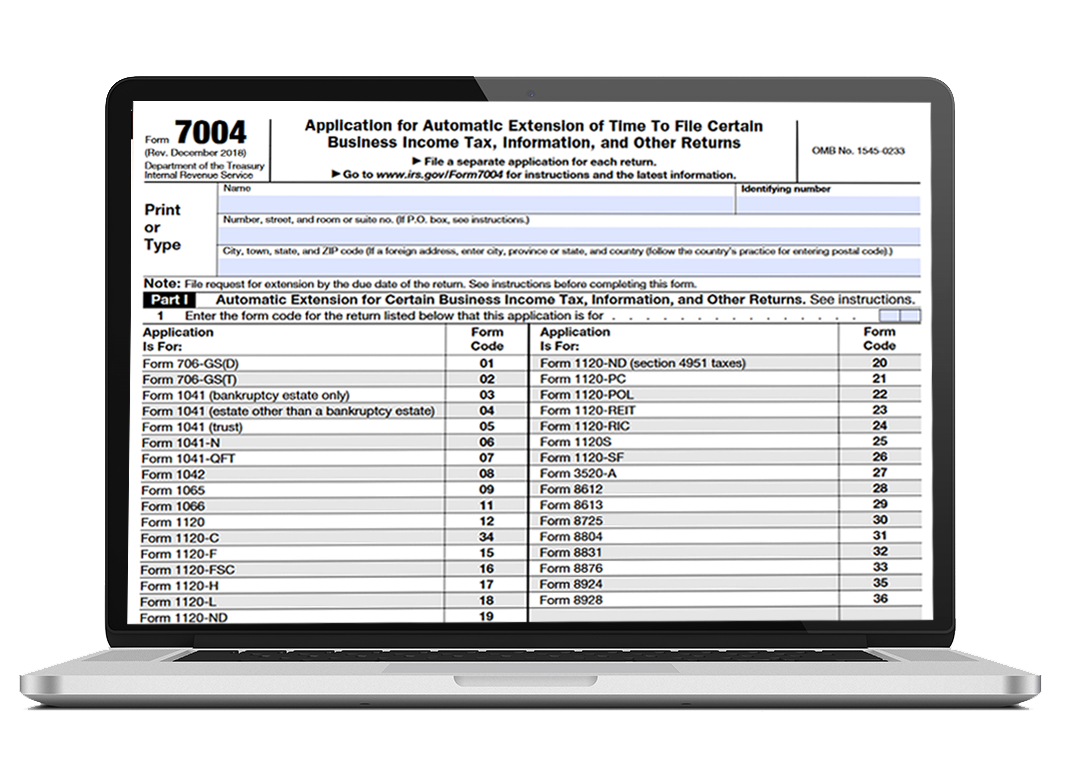

Form 7004 is an IRS form used to request an automatic 6-month extension of time to file certain business income tax, information, and other returns. It is most commonly used by businesses, estates, trusts, and others to request an extension of time to file a tax return.

Note: Filing Form 7004 provides an extension for filing your tax return, but it does not extend the due date for any taxes owed.

Form 7004 Filing Requirements

Businesses that need additional time to file their income tax returns, including Forms 1120, 1120-S, 1065, 1041, and more, include:

- Corporations

- Partnerships

- LLCs

- Certain Trusts and Estates

Form 7004 Deadline

The deadline to file Form 7004 depends on the form you need to extend, the business type, and its tax year.

- For businesses filing Form 1120-S, 1065, or other certain tax returns, the deadline is March 17, 2025.

- For businesses filing Form 1120, 1041, or other certain tax returns, the deadline is April 15, 2025.

Meet Your Business Tax Filing Deadline With ExpressExtension

Information Required to File Form 7004

- Business Details - Name, EIN, and Address

- Type of Business Structure

- Type of Forms for which you need to file an extension

- Tax Year details (Calendar or Fiscal Tax Year)

- Tax Payment & Balance Due Details

Click here to understand Form 7004 filing requirements.

How to file Form 7004?

Businesses can file Form 7004 either electronically or by paper.

However, the IRS recommends filing electronically for faster processing and instant filing status.

To simplify e-filing Form 7004, get started with the IRS Authorized e-file provider, ExpressExtension, and follow these simple steps:

- Step 1: Enter your business details.

- Step 2: Choose the form and your business entity type.

- Step 3: Enter your tax payment details

- Step 4: Review and Transmit your Form 7004 to the IRS.

Once you transmit, you’ll get an instant status update of your extension via email.

Advantages of Filing Form 7004 Electronically with our Software

Form7004.net is the leading IRS-authorized e-file provider offering a secure cloud-based platform to file business tax Extension efficiently

What’s E-file Form 7004 with Us?

- Get your Extension in less than 5 minutes from any device

- Get your 7004 Extension approved or Money Back*

- Copy data from a previously accepted return

- Instant IRS Status Updates

- Supports State Business Tax Extension

Other Available Tax Extension Forms

Visit ExpressExtension to know more!